Courtesy the India Post Payment Bank (IPPB), the postman will now be our banker – what a change for the humble khakhi uniformed man or woman who can be seen across the country, delivering mail, writing letters or reading them, handing over money or taking deposits.

Courtesy the India Post Payment Bank (IPPB), the postman will now be our banker – what a change for the humble khakhi uniformed man or woman who can be seen across the country, delivering mail, writing letters or reading them, handing over money or taking deposits.

The postman has been featured in numerous Bollywood movies, and invariably, he/ she is a trusted community member. This is normal considering that India Post was founded in 1774, and in March 2015 had 154,939 post offices (about 90% in rural India and 10% in urban areas). From as far back as I can remember, the post office small savings scheme is very popular among small traders because of the micro payments accepted, plus the large network of agents.

As per the PIB press release of October 03, 2016 it seem that IPPB has kicked off a recruitment drive for senior management positions and more. The bank will launch 650 branches and will be operational by September 2017.

While starting a bank is a BIG challenge, as we are not banking specialists, the IPPB will face a different challenge itself considering the size of the organization trying to reinvent itself.

IndiaWatch will be happy to see IPPB take off and achieve success, however, considering the working of government departments and PSUs there are a few recommendations which may not be on the radar of the IPPB planners.

Advantage of India Post credibility and reach:

- IPPB will be the biggest banking rollout in the world and possibly has the biggest advantage. 154,000 post offices across the country is huge and every Postman is a trusted member of the community he / she is serving. Illiterate rural folk depend on these postal employees to read and write letters, receive and send letters and money. India Post employs about 460,000 postmen/women, along with thousands of agents, also help mobilize small and micro savings and deposits.

- This is a big advantage for IPPB and while the new management is looking at hiring contract employees, it will be advantageous to retrain the existing postmen and women across the country. The credibility of the postal department is impeccable and waiting to be

- Then there is the ability to reach every corner of the country and there is a hugely winning proposition.

IPPB has to break out of the legacy mindset:

- The Postal Department and the Postal Union has a legacy to shed, and IPPB will have to face this too. Though IPPB is a new entity, the promoter is India Post and this fact cannot be overlooked. It is important for both organizations to put in effective training programs and enable current employees to take up new roles and responsibilities.

- Over the years, one has seen changes in the attitude and working of the department employees as well as the modernization of India Post.

- So…. There is hope!

Technology Adoption

- As the newest bank on the block, IPPB has the opportunity to kickstart their operations with the best and latest technology.

- However there is the opportunity for the bank to bring in cutting edge technology for their banking operations but in operations and technology risk management too. Since the IPPB will reach out to the rural areas through India Post, it will be good to include technology tools like handhelds enabled with UPI, NFC, Mobile Payment, Bluetooth, Email capability.

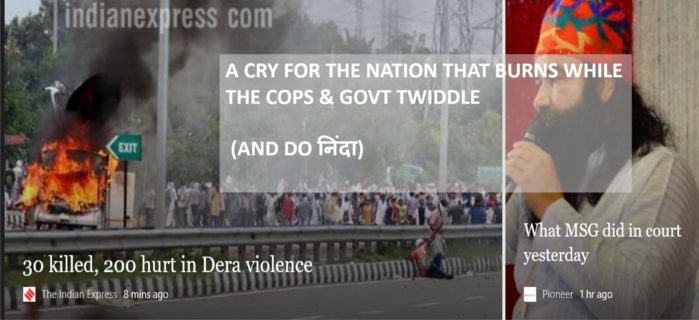

Easy Last Mile Reach

- Rural India population is largely illiterate and technologically challenged. As such, with the spread of technology availability in the remotest corners of the country, the threat of cybercrime will grow exponentially and there will be a desperate need to make the population aware of the risks knocking at their doorstep.

- Banks are faced with increasing cybercrimes, and, on a daily basis one reads about some poor illiterate person being cheated or robbed through social engineering.

- This is where the IPPB can score high if they empower the postman at the last mile to deliver appropriate awareness training and enable security thought / action in the rural populace. There will be millions of first time users who can be trained at the start itself, but the last mile representative.

- One may think that this is easier said than done, but the country has numerous examples of grassroots level change initiatives – in healthcare, hygiene, swach Bharat etc.

Identity Verification Using Human Factor

- Another advantage for the IPPB is the verification of the account holder.

- As everyone knows, the KYC process in banks is weak, there is a move towards inclusion of Aadhaar based biometrics as a second factor for authentication. However, biometrics of rural folk tend to be unreliable considering that their fingerprints may not be available due to the work they are engaged in.

- At this point comes the local postman who knows the account holder in person and can vouch for his / her authenticity if the biometrics do not match. In such a situation where the biometrics do not match, the postman banker can do a positive identity verification, and take a selfie with the account holder at the time of the transaction, or get that person to enter a passcode. Any levels of authentication can be added over (or under) the personal identification which will be paramount.

Cyber Security

- IPPB has the advantage of being the new kid on the block which means they can enable security features in their people, process and technology at the foundation level itself. They also have the opportunity to bring in cutting edge technologies like blockchain, deception, artificial intelligence etc.

- Due to the sheer size and reach, IPPB will have to be careful that this strength / advantage does not become it’s Achilles’ heel. The same rural population which is the target for getting millions of accounts going may also land up being the most targeted segment for cybercrime. As such, the bank will also have a social responsibility to ensure that it does not become the biggest conduit for money laundering or the biggest repository of victims of cybercrime.

People – The Biggest Challenge

- As mentioned earlier, the legacy thought process has to be surmounted. Frist there is the general thinking that government employees are lazy and complacent and that we cannot expect them to be productive or efficient.

- Personally speaking, one has seen a big change in the working style of the postman but then it will be to their own benefit to break out of the old thought process.

- Yes, the postal employees will have to shed their legacy thought process to take advantage fo the opportunity that will come with IPPB. And this will not be too difficult.

- IPPB will do well to “look inwards” – at the hundred thousands who will be first account holders and well wishers for the bank.

In conclusion it will be well worth to watch and hope for the success of IPPB. It is high time the Government departments came out on their own, flexed their muscles and showed the world that they can do good. The government employee is highly under-rated, under-utilized and abused by all. This is a creature of it’s own making and no human being would like to be categorized as a wastrel and can be made to reach great heights.

Wishful thinking – one may say! But we must not forget that the human being is highly resilient and can be made to achieve miracles. And this is what one hopes from the postal department too.

http://pib.nic.in/newsite/PrintRelease.aspx?relid=151385

IPPB has the advantage of being the new kid on the block which means they can enable security features in their people, process and technology at the foundation level itself. They also have the opportunity to bring in cutting edge technologies like blockchain, deception, artificial intelligence etc.